Uncategorized

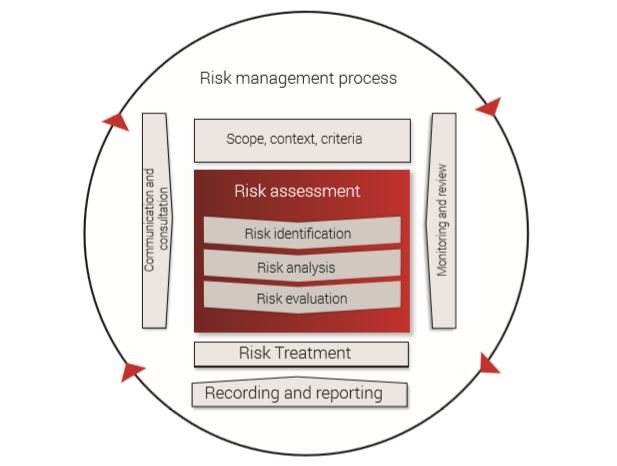

ISO 31000 Risk management

Courtesy: ISO 31000 Risk management

Accordingly, senior position holders in an enterprise risk management organisation will need to be cognisant of the implications for adopting the standard and be able to develop effective strategies for implementing the standard, embedding it as an integral part of all organizational processes including supply chains and commercial operations. In domains that concern risk management which may operate using relatively unsophisticated risk management processes, such as security and corporate social responsibility, more material change will be required, such as creating a clearly articulated risk management policy, formalising risk ownership processes, structuring framework processes and adopting continuous improvement programmes.

Certain aspects of top management accountability, strategic policy implementation and effective governance frameworks including communications and consultation, will require more consideration by organisations that have used previous risk management methodologies which have not specified such requirements.

Managing risk

ISO 31000 gives a list on how to deal with risk:

- Avoiding the risk by deciding not to start or continue with the activity that gives rise to the risk

- Accepting or increasing the risk in order to pursue an opportunity

- Removing the risk source

- Changing the likelihood

- Changing the consequences

- Sharing the risk with another party or parties (including contracts and risk financing)

- Retaining the risk by informed decision

Risk management is the identification, evaluation, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

Risks can come from various sources including uncertainty in international markets, threats from project failures (at any phase in design, development, production, or sustaining of life-cycles), legal liabilities, credit risk, accidents, natural causes and disasters, deliberate attack from an adversary, or events of uncertain or unpredictable root-cause.

There are two types of events i.e. negative events can be classified as risks while positive events are classified as opportunities. Risk management standards have been developed by various institutions, including the Project Management Institute, the National Institute of Standards and Technology, actuarial societies, and ISO standards. Methods, definitions and goals vary widely according to whether the risk management method is in the context of project management, security, engineering, industrial processes, financial portfolios, actuarial assessments, or public health and safety. Certain risk management standards have been criticized for having no measurable improvement on risk, whereas the confidence in estimates and decisions seems to increase.