CTPAT customs trade partnership against terroism, Uncategorized

CTPAT CUSTOMS TRADE PARTNERSHIP AGAINST TERROISM 4

In direct response to 9/11, the US Customs Service, now U.S. Customs and Border Protection (CBP) challenged the trade community to partner with CBP to design a new approach to supply chain security focused on protecting the United States against acts of terrorism by improving security while simultaneously speeding the flow of compliant cargo and conveyances. The result was a voluntary government-business initiative, named Customs-Trade Partnership Against Terrorism (C-TPAT).

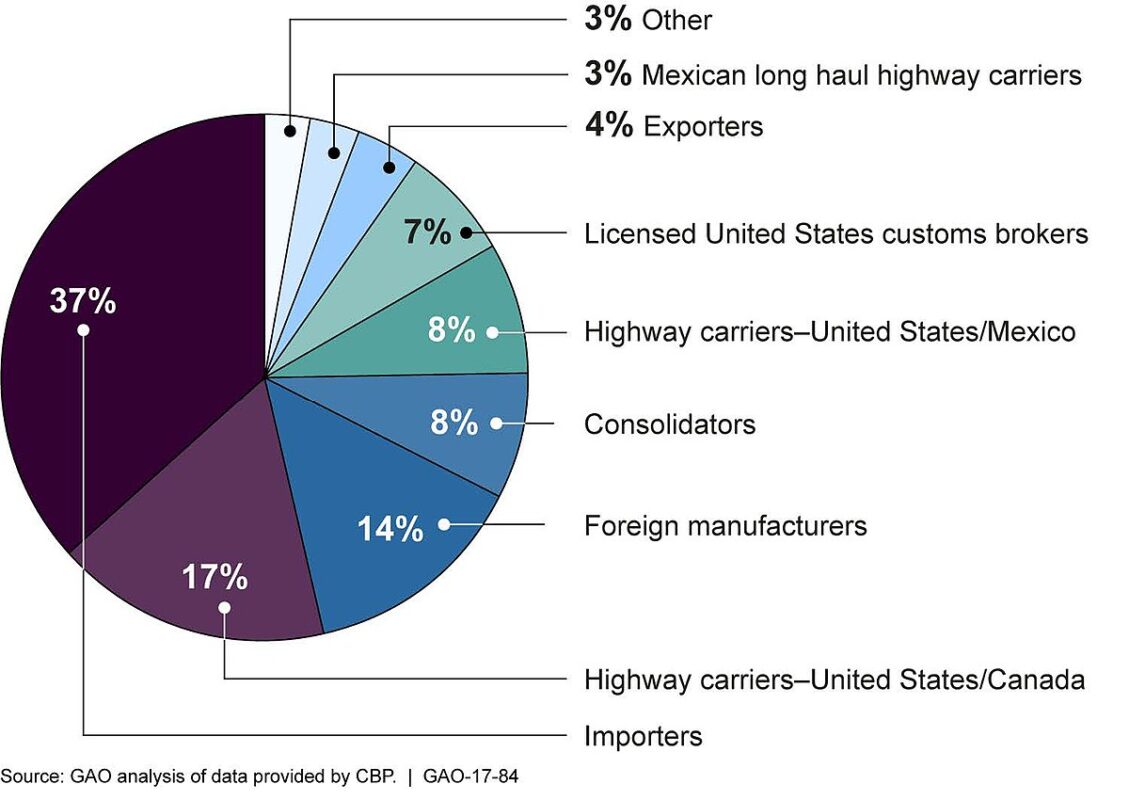

C-TPAT was created to build cooperative relationships. U.S. Customs and Border Protection (CBP) declared that they can provide the highest level of cargo security only through close cooperation with the ultimate owners of the international supply chain such as importers, carriers, consolidators, licensed customs brokers, and manufacturers.

This program affects every border of the United States. With C-TPAT, the U.S. Department of Homeland Security aims to prevent any scenario which could result in a terrorist attack. The impact on the U.S. economy from a detonated bomb in a U.S. seaport or railroad station was estimated by the U.S. Department of Homeland Security as follows:

- The closing of every U.S. seaport (for over a week),

- A backlog of container traffic that requires 92 days to clear,

- A 500 point drop in the DOW,

- A cost to the U.S. economy of $58 billion,

- Chronic economic repercussions for U.S. trading partners, plus

- The incalculable loss of human life.

In November 2001 (shortly after 9/11), C-TPAT was launched with seven participants. The first C-TPAT members are some of the biggest importers of the United States such as BP America, DaimlerChrysler, Ford Motor Co., General Motors Corp., Motorola, Sara Lee, and Target. By April 2005, 9000 companies ranked among the C-TPAT participants and constituted 42% of all imports to the United States. C-TPAT is still voluntary, but members of the trade community believe that the government will eventually make C-TPAT participation mandatory.

What is the effect of C-TPAT on pharmaceutical drug importers?

Companies that import non-critical merchandise (clothes, automobile, etc.) are those who have been impacted most by the change in environment since 9/11. Before 9/11, many of these containers would go through U.S. Customs without being opened. Now, with higher security measures in place, Customs intends to open all containers for inspection. Membership in C-TPAT will facilitate a more timely process for these companies.

For those companies shipping more critical merchandise (electronic devices, drugs, chemicals, etc. ) their containers have always received close inspection by U.S. Customs. The question arises for these companies, why would they consider participation in C-TPAT? This is a question each company must answer for themselves. There are benefits and there are costs to consider.

How does a company benefit from being a member of C-TPAT?

The U.S. Customs and Border Protection (CBP) offers several benefits for participating companies. Firstly, these companies can experience reduced border delays since they will receive priority processing for CBP inspections. The frequency of these inspections will be reduced. They will be entitled to a Customs account manager, and be eligible for account-based versus shipment-based processing. All of these items will contribute to a faster and more robust import process.

Applying for C-TPAT requires companies to thoroughly evaluate their import process. Consequently, companies may improve internal processes and controls. As good business practices are employed, companies increase efficiencies and save money. Networking with other C-TPAT participants might also convey benefits.

If the company is currently dealing with detailed customs inspections, increased border delays, and increased effort in managing shipments (and therefore with back-orders, customer complaints, unhappy employees and higher importation costs), C-TPAT membership is certainly worth taking in consideration.

What is involved in qualifying for C-TPAT?

The efforts to get qualified for C-TPAT involves a long and extensive process: The participant must complete an online electronic application on www.cbp.gov (includes submission of corporate information, a supply chain security profile, and an acknowledgement of an agreement to voluntarily participate). Additionally, the participant must conduct a comprehensive 40-page self-assessment of its supply chain security procedures using the C-TPAT security criteria or guidelines. Those criteria or guidelines encompass the following areas: Business Partner Requirements, Personnel Security, Procedural Security, Education and Training, Physical Security, Access Controls, Manifest Procedures, Information Security and Conveyance Security.

Upon satisfactory completion of the application and supply chain security profile, the company will be assigned a CBP C-TPAT Supply Chain Security Specialist (SCSS). The SCSS will contact the applicant to begin the C-TPAT validation process. This may involve an on-site visit to assure the company is compliant with

C-TPAT requirements.

For C-TPAT compliance, several people and departments are involved from the port of origin (where the goods are manufactured) to the arrival at the importer’s warehouse in the United States. Within the company, some of the departments affectedare: Human Resources (for pre-employment screening, background checks of new employees, security trainings), IT (identifying, tracking, security), Warehouse (receiving, shipping, packing, packaging), Facilities Management (fencing, gates, parking, alarm system) and General Management. C-TPAT requires that one management person is assigned responsibility for overall security.

The certification process and the operation with C-TPAT would not only consume a large amount of time and employees, there are also expenses in several areas. For example, participants must (1) provide or improve physical security of buildings, plants and yards, access controls, electronic tracking and monitoring systems and controls, (2) hire and train security staff, and (3) possibly hire a company to assist in the certification process to do background personnel checks. Companies are also responsible for training and information seminar costs. The overall total costs depend on the size of the company and are usually estimated between $10,000 and $60,000; however, some companies have spent over $100,000 just to qualify. While this may seem like a high cost, companies need to weigh this against the thousands of dollars that may be spent throughout the year in shipment delays. Detention of shipments at the border can result in lost sales opportunities, demurrage charges, exam fees, and even destruction of product.

A company considering participation in C-TPAT must weigh the benefits and costs of C-TPAT participation with the high risk of not participating and the large amount of costs that may come along with this risk. There are already various costs of delays at the border for non-participants. There is more scrutiny by U.S. Customs inspectors, access to “fast” lanes or booths is refused, higher transportation and logistics costs arise, and – should there be another terrorist event in the future – there will also be the possibility of being denied access to the United States.

There is no overall answer to the question if C-TPAT applies to every single company. The advantages and disadvantages for the individual company according to size, type of products and amount of imports need to be summed up and weighed before a decision for or against C-TPAT participation can be made. Homeopathic Drugs importers are small compared to companies like Target or General Motors and cannot invest large amounts of money into supply chain security.