Sale!

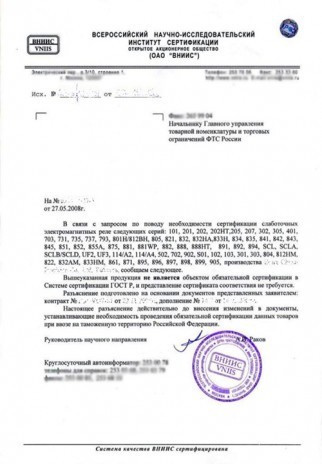

Exemption Letters For Customs And Sales

Original price was: ₹240,000.00.₹120,000.00Current price is: ₹120,000.00.

Exemption letters for customs and sales are official documents that provide individuals or organizations with exemption from certain taxes, duties, or fees. These exemptions are usually granted for specific reasons, such as diplomatic status, charitable activities, or special trade agreements. Below are examples and explanations of exemption letters for customs and sales:

### Customs Exemption Letter

**[Your Company Letterhead]**

**[Date]**

**Customs Authority Name**

**Address**

**City, State, Zip Code**

**Subject: Request for Customs Duty Exemption**

Dear [Customs Authority Name],

I am writing on behalf of [Your Company Name], located at [Company Address], to request an exemption from customs duties for the importation of [Description of Goods]. These goods are intended for [Brief Purpose of Import, e.g., research and development, charity, etc.].

We believe that our organization qualifies for this exemption under [Specific Regulation or Treaty, e.g., Article 6 of the Vienna Convention on Diplomatic Relations]. Enclosed are the necessary documents to support our request, including [List of Required Documents, e.g., Diplomatic ID, Import License, etc.].

We kindly request your prompt attention to this matter and appreciate your assistance in facilitating the customs clearance process for our goods.

Please do not hesitate to contact us at [Contact Information] if you require any additional information or clarification.

Thank you for your cooperation.

Sincerely,

**[Your Name]**

**[Your Position]**

**[Your Company Name]**

**[Contact Information]**

—

### Sales Tax Exemption Letter

**[Your Organization Letterhead]**

**[Date]**

**State Tax Authority**

**Address**

**City, State, Zip Code**

**Subject: Sales Tax Exemption Request**

Dear [State Tax Authority],

I am writing to request a sales tax exemption for purchases made by [Your Organization Name]. As a [Description of Your Organization, e.g., non-profit organization, government entity, etc.], we believe we are eligible for this exemption under [Specific State Regulation or Code, e.g., Section 501(c)(3) of the Internal Revenue Code].

Enclosed are the required documents to support our exemption request, including our tax-exempt certificate and [Any Other Required Documents].

We kindly ask for your assistance in processing this exemption request and ensuring that our future purchases are exempt from sales tax as per state regulations.

Should you require any additional information or documentation, please feel free to contact us at [Contact Information].

Thank you for your attention to this matter.

Sincerely,

**[Your Name]**

**[Your Position]**

**[Your Organization Name]**

**[Contact Information]**

—

**Note**: These are sample letters and should be customized to fit the specific circumstances of your situation. Always consult with legal or tax professionals to ensure compliance with local, state, and international regulations.

Reviews

There are no reviews yet.